I hope you are enjoying some sunshine after the last few weeks of wet weather, which was officially Sydney’s wettest start to the year on record. Though we may all be enjoying some blue skies and fine weather, it would seem there are some storm clouds building in the investment markets which is a reason for this market update.

In my 23 years as an investment advisor, I don’t recall a period such as we are seeing now, with multiple challenges – all of which seem to be aligning at the same time. After incredibly strong returns in both shares and property in 2021, we have seen some volatility and downward pressure creeping in since the beginning of the year. Below are a few short bullet points outlining some of the issues that are impacting the markets, and may impact your portfolios. Make sure to read to the end to see some positive news!

Geopolitical Risks

Everyone is aware of what is currently occurring in Ukraine and, without dismissing the terrible impact this is having on the people of Ukraine, there are significant economic impacts flowing out of this situation. Many countries have imposed sanctions on Russia in an attempt to cripple Russia’s economy. Russia’s currency has plummeted and it is highly likely in the next few days we will see Russia default on its foreign debt, an event which last occurred in 1998 during the Russian financial crisis. Any default by Russia will likely have flow on effects to the global economy, there is a more detailed analysis included in the Financial Times (FT) link below. We have also seen the impact from the Russian conflict on global commodity prices, with increases over the last 6 months in Oil (42%), Wheat (52%) & Coal (111%). If you would like to see where these figures came from – and check out movements in other commodities – please click the commodities prices link below.

Rising Inflation / Rising Interest Rates

US inflation is running at the highest level it’s been in the last 40 years, close to an annual rate of 8%. Without getting overly complex, when inflation is running hot as it is now, Central banks tend to increase interest rates to reduce inflation and slowdown economic growth. In the next day or two it’s likely that the Federal Reserve in the US will increase rates for the first time since 2018, with Australia’s Reserve Bank likely to follow pace soon after. There is a link below if you like to read a little bit more on this topic.

Covid

As you may be aware, cases are again trending upwards in Australia, with talk of a new variant – obviously the next few weeks will verify how this plays out. At this point in time, the big news regarding Covid is that China is now battling its largest Covid outbreak since the start of the pandemic – with multiple large cities now in lockdown. Shenzen – a city of almost 18 million, and China’s main technology hub is now in lockdown for at least the next six days. These lockdowns are having an impact on the Chinese share-market and potentially may also see a flow on impact to global supply chains.

THE GOOD NEWS

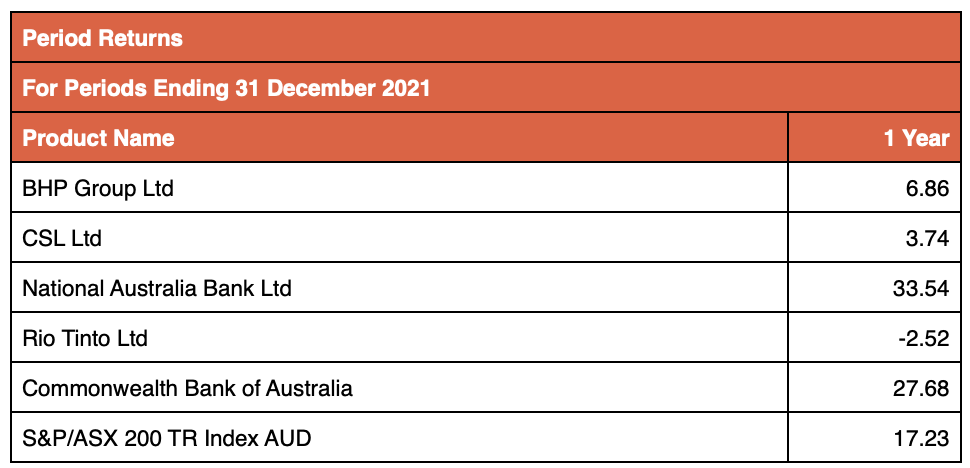

Through all this bad news, I would flag that the Australian economy remains in pretty good shape. With inflation rising, and potentially rising for the foreseeable future – regardless of the investment headwinds in play – in a low interest rate environment the argument for continuing to hold growth assets remains strong. Whether it’s property or shares, a good quality growth asset is the ultimate hedge against inflation. The Australian Bureau of Statistics recently released figures on the change in property prices across the capital cities in Australia during 2021 (link below), which showed significant increases across the board. I’ve also included a chart below showing the one year returns (ending December 2021) for the five largest companies on the ASX, as well as the combined performance of the top 200 companies measured by the ASX 200 index.