Everyone’s curious about how their investments did last year. Here’s what you need to know:

Everyone will be anticipating what their superannuation fund will return for the 2023/24 financial year, with an expectation that an average balanced fund will return somewhere between 8% to 9% for the year. AustralianSuper – the largest superannuation fund in Australia, has confirmed an annual return for the 23/24 financial year of 8.50% for accumulation members within their default “Balanced” option.

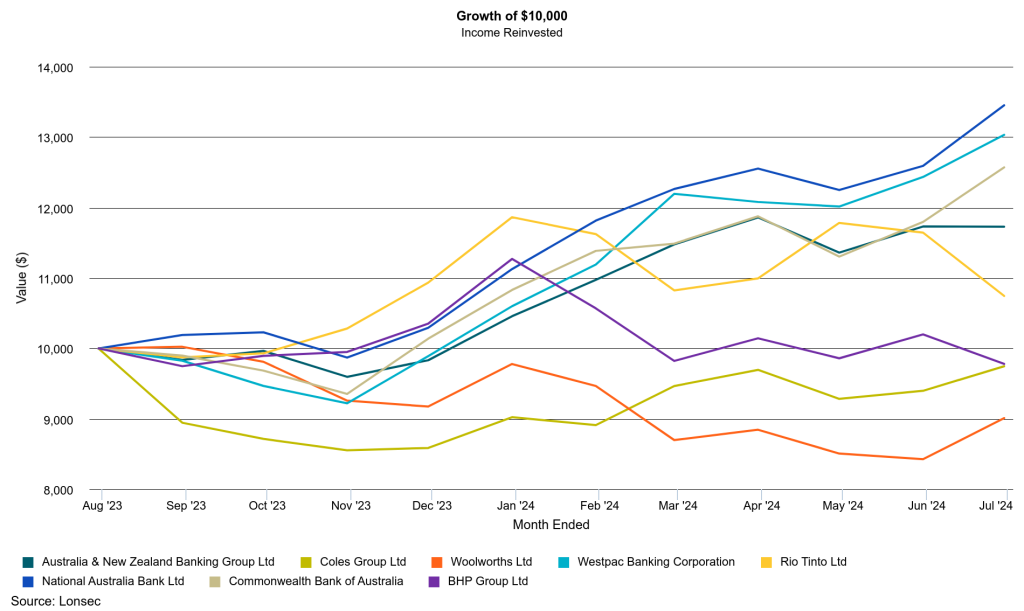

For Australian shares, it has been another good year, although returns varied across our major companies on the ASX. Here’s a snapshot of how $10,000 invested from 1 July 2023 to 30 June 2024 performed, assuming dividends were reinvested. We compared the four main banks, our two biggest miners (BHP & Rio Tinto), and our two major supermarkets (Woolworths and Coles)

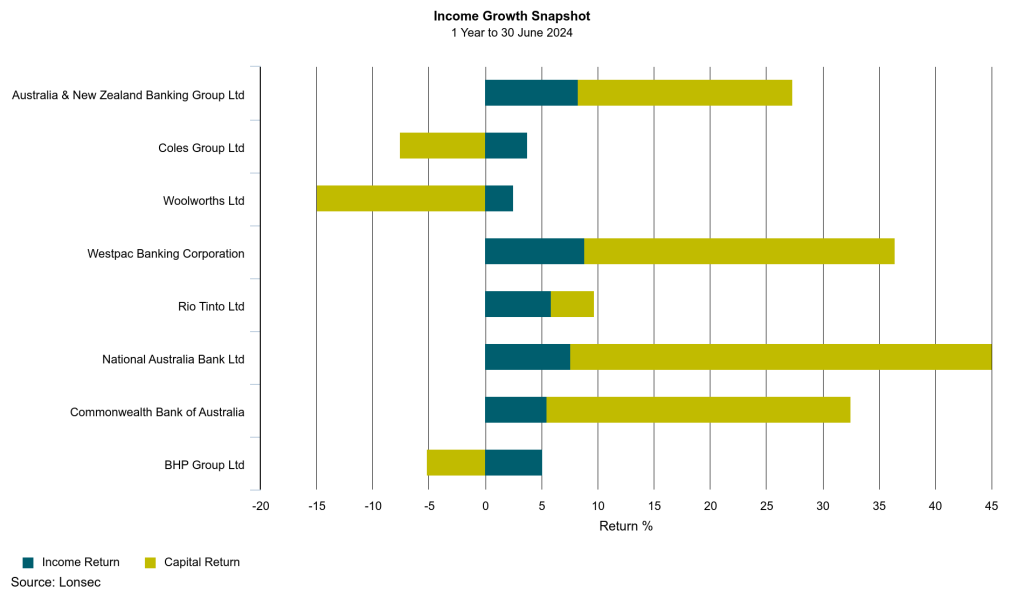

The bar graph below outlines the capital growth return (green bar) and income return (blue bar) each of these shares generated in the last 12 months.

The banks did great, Rio Tinto outperformed BHP, while the supermarkets lagged behind a bit.