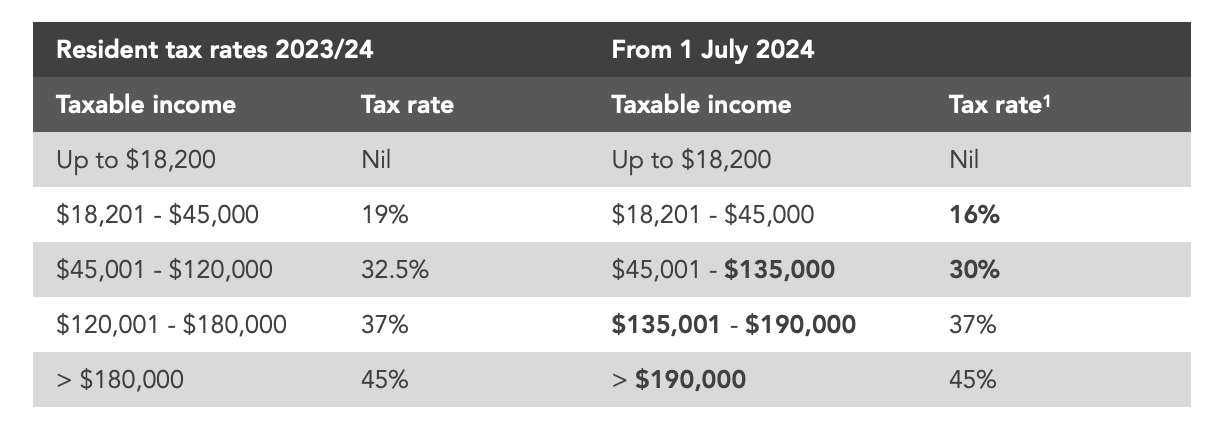

Great news! From 1 July 2024, everyone gets a tax cut. Here’s a quick look at the new tax rates compared to last year (these rates exclude the 2% Medicare levy):

Want to see how much extra you’ll be taking home this year? Check out the Tax Cuts Calculator provided by the Australian Government.

Superannuation Contribution Limits

Some good news for your super contributions:

-

Concessional Cap (CC): Up from $27,500 to $30,000.

-

Non-Concessional Cap (NCC): Up from $110,000 to $120,000.

-

Three-Year Bring-Forward NCC: Up from $330,000 to $360,000.

-

Superannuation Guarantee (SG) Rate: Up from 11% to 11.50%.

And here’s something really important if you’re aged between 65 and 74: you can still make contributions to your superannuation, regardless of whether you’re working or retired. The increased contribution limits provide an excellent opportunity to top up your super balances. Whether you’re still in the workforce or enjoying your retirement, these higher limits make it easier to boost your superannuation savings, giving you more financial security and flexibility in your retired years.