As we reflect on the investment landscape of 2023, one undeniable lesson emerges: the importance of diversification in achieving financial success. The past year has seen remarkable fluctuations across major investment markets, reaffirming the age-old wisdom of not putting all your eggs in one basket.

Portfolios with global share exposure emerged as significant winners in 2023. The MSCI World Index and the S&P 500 delivered impressive returns of 23% and 24%, respectively, over the course of the year. Meanwhile, the Australian sharemarket had a late surge, culminating in a solid 12% return for the year, with 8% of it concentrated in the final three months alone.

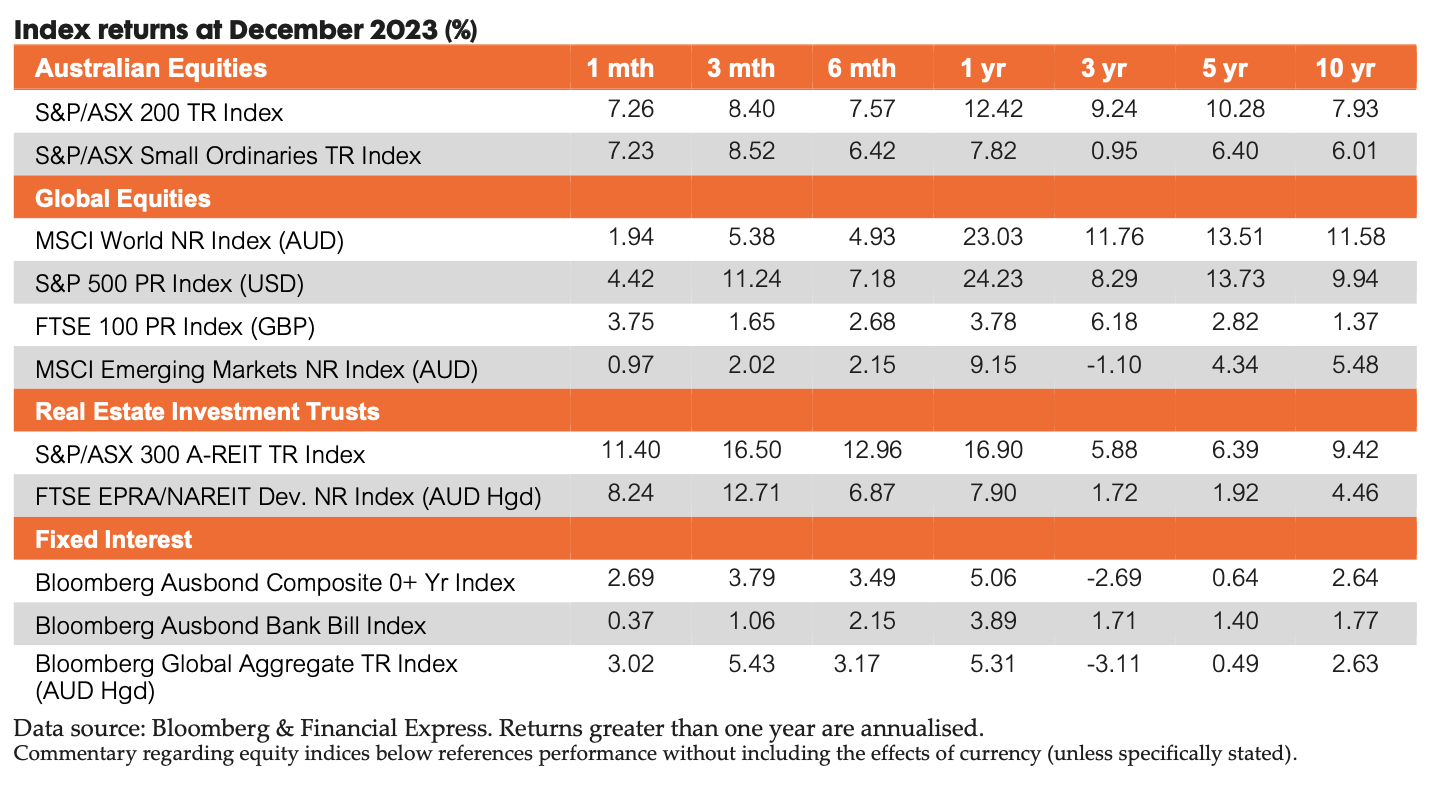

This pattern underscores the value of diversifying investments across various asset classes. While one market may experience a downturn, another could be flourishing, helping to mitigate risk and potentially enhance overall returns. The chart below illustrates the returns of different asset classes, reinforcing the notion that exposure to a diverse range of investments can yield favourable outcomes over the medium to long term.