How Has Your Suburb Fared in the Property Market Over the Last 10 Years?

We understand that many of you may have seen a recent reduction in the value of your property holdings, which can be attributed to the dramatic increase in borrowing rates. As interest rates continue to rise, there has been downward pressure on property prices due to reduced borrowing capacity of consumers.

However, we would like to remind you that property remains an attractive investment over the medium to longer term. For your interest, we have provided a link below to a tool on realestate.com.au where you can enter your post code/suburb and see the 10-year growth rates of a house or unit.

For comparison purposes, we have also included a graph that shows the percentage return of the Australian Share market (measured by the ASX200 index) and Gold over the same 10-year period. As you can see from the graph below, the ASX200 has returned around 110%, while gold has returned around 130%. It is worth noting that although gold is often considered a “safe haven,” it has actually been more volatile than the Australian Share market.

Estate Planning

As the old saying goes, death and taxes are the two certainties in life. Although Australia no longer has death duties, there can be significant taxes to pay when a person passes if their estate matters are not in order. That is why we highly encourage you to have valid and current estate planning documents in place and establish a suitable estate plan.

By doing so, you can achieve the following benefits:

- Protect assets so they are distributed as per your wishes.

- Protect yourself by planning for incapacity. You can do this by nominating someone to make decisions for you if you can’t, including financial, medical, and lifestyle decisions.

- Protect your loved ones by nominating guardians for minors and/or establishing trusts for ongoing support of those loved ones.

- Reduce family conflict after you have departed by minimising disputes within your family and reducing the likelihood of legal challenges.

- Achieve peace of mind by knowing your wishes will be carried out when your time comes and reduce headaches/issues for those left behind.

If you have any concerns regarding these matters, please get in touch. We can provide advice/options to consider and either work with your existing legal adviser or refer you to one of several lawyers we work with who can assist. Remember, it’s never too early to start planning for these future events and ensuring that your wishes are met.

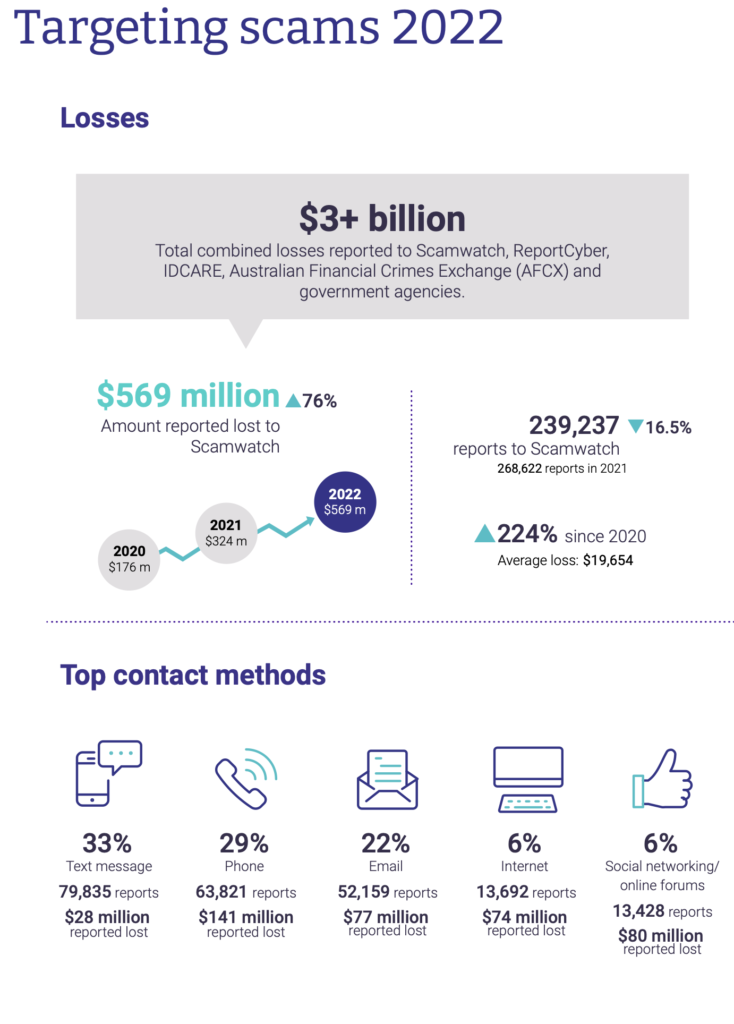

Investment Scams

Investment scams continue to be a major concern, and it’s vital to remain vigilant. According to the latest data from Scamwatch, Australians reported a staggering $570 million to Scamwatch in 2022, with a staggering total of $3.1 billion in reported scams across all government agencies. This is an 80% increase on total losses recorded in 2021. Investment scams were the most significant contributor to these losses, followed by remote access scams and payment redirection scams. It’s now more important than ever to take steps to protect yourself from scammers.

Scammers have now even found ways to send text messages that appear to follow on from legitimate messages you may have previously received from your bank or other organisations and even calls that seem to originate with your bank. To avoid falling victim to these scams, follow the official advice:

STOP – If you receive a message out of the blue, be cautious. Don’t click on any links or provide any personal information or money if you’re unsure. Scammers often pretend to be from trusted organisations like Services Australia, ATO, police, banks, government, or fraud services.

CHECK – Never click on a link in a message. Only use contact information from official websites or secure apps when contacting businesses or government agencies. If in doubt, say no, hang up, or delete.

ACT – If you notice any unusual activity or suspect a scammer has taken your money or information, contact your bank immediately. Seek help from IDCARE and report to ReportCyber and Scamwatch.

Moneysmart.gov.au offers useful tips and guides on how to protect yourself: https://moneysmart.gov.au/protect-yourself-from-scams

The graphic below is a summary of reported scam activity from 2022.

As always, if you have queries or wish to discuss your specific financial situation, please get in touch, or book in a meeting / call time with me via the following link: